Over the past few years, the non-fungible tokens or NFTs market inside the crypto industry has grown significantly, reaching a volume that exceeds several billion dollars. While blockchain advocates see this as a positive indicator of the widespread crypto adoption, the sheer amount of money circulating in this emerging economy also renders NFTs a lucrative opportunity for scammers.

According to Bloomberg, the NFT market size surpassed $40 billion in 2021. The number of scams aimed at the NFT sector continues to increase proportionally with the growth of this sector. It's alarming to consider how many potential NFT scams exist out there. Cybercriminals seem to devise a new method of deceiving unsuspecting NFT collectors and traders every week. However, if you understand what you are looking for and watch out for potential scams, you will benefit from this exciting sector without worry.

At NotCommon, we continuously seek your safety against NFT cybercriminals and scammers. This article will explore another deceitful scam that scammers constantly use to rip off NFT collectors. Previously in our "Common NFT Scams" series, we discussed NFT Customer Support Scams, Rug Pulls, and airdrop trojan horse NFTs.

What is NFT Bidding Scam?

Fake bidding is a common NFT scam that typically occurs when a legitimate seller attempts to auction off an NFT. Once you acquire an NFT, you will likely link your wallet to OpenSea, the leading NFT marketplace to explore, purchase, and trade NFTs; it also may have several risks for unsuspecting users. In the latest OpenSea scam, once you list your NFT for sale, bidders may switch the bid’s cryptocurrency without informing you. Scammers do this to trick NFT sellers into selling their NFTs for lower prices than the original ones.

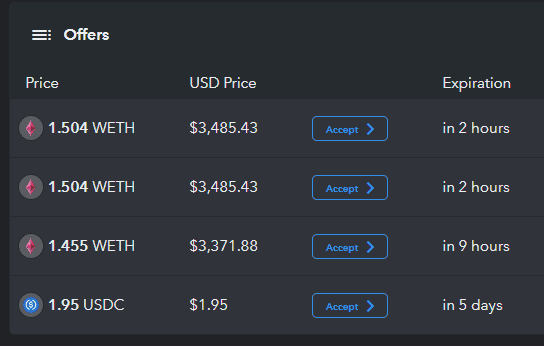

For instance, bidders will offer the price you want to sell your NFT, but in USDC currency rather than WETH or ETH. USDC has a lower worth than WETH or ETH, so technically, you may end up receiving less money for your NFT sale.

NFT bid Offers on OpenSea, which include a deceitful bid.

Some scammers take this approach further by altering their profile picture with the WETH logo. As a result, you may believe, "Wow, somebody just bid 1.95 WETH for my NFT item!" before actively verifying and immediately selling, only to discover you got 1.95 USDC instead of 1.95 WETH.

The simplest way to avoid this is to be careful and systematic while going through your bids. To prevent a deceitful bid, you must check the USD price for every bid before accepting it. This should be considered basic knowledge, yet scammers do fool people in this manner. If you ever experience such scams, report to OpenSea or Rarible help center and NotCommon Security.

Other Types of NFT Bidding Scams:

The most common type of NFT bidding scam is when a scammer places the highest bid on an NFT and substitutes a lower-value cryptocurrency when it is time to pay. In such cases, always confirm what cryptocurrency the top bidder is paying before accepting if you're selling your NFT.

Besides the highest bidder scam, bidders may use other social engineering techniques to deceive NFT sellers. This may happen from the seller's side as well in some cases. For example, an NFT seller may use a bidding scam to sell their listing.

If a seller adjusts the decimal point by one place to the right when adding or removing an NFT listing, a consumer may spend far more than they intended to without even realizing anything was different. Therefore, examining the cost before making a purchase is essential, just as it is in the real world.

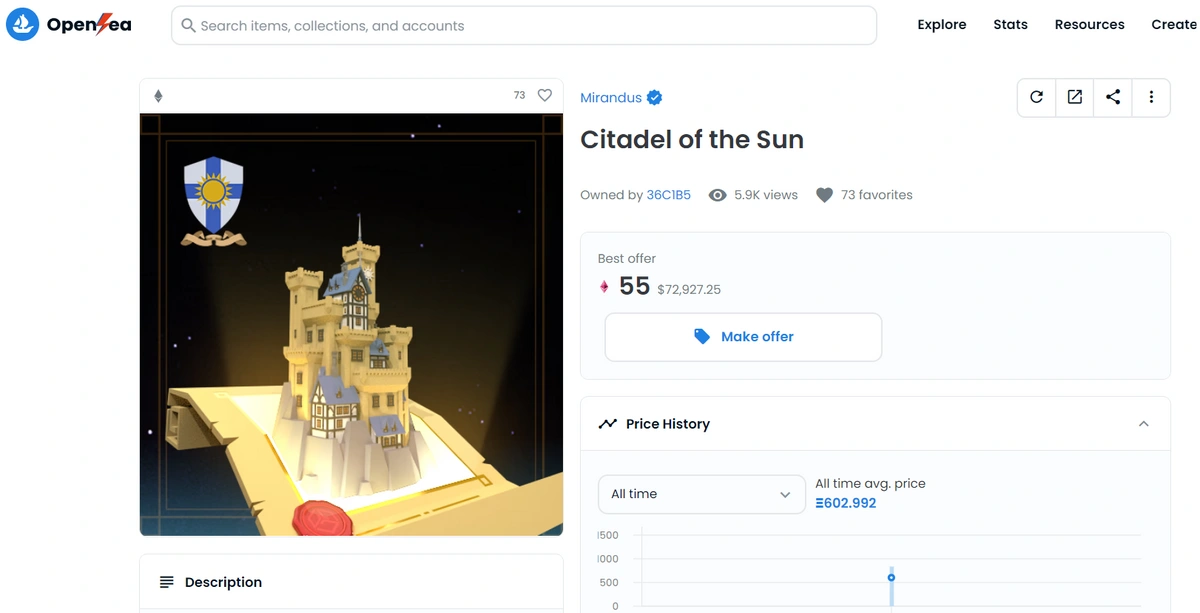

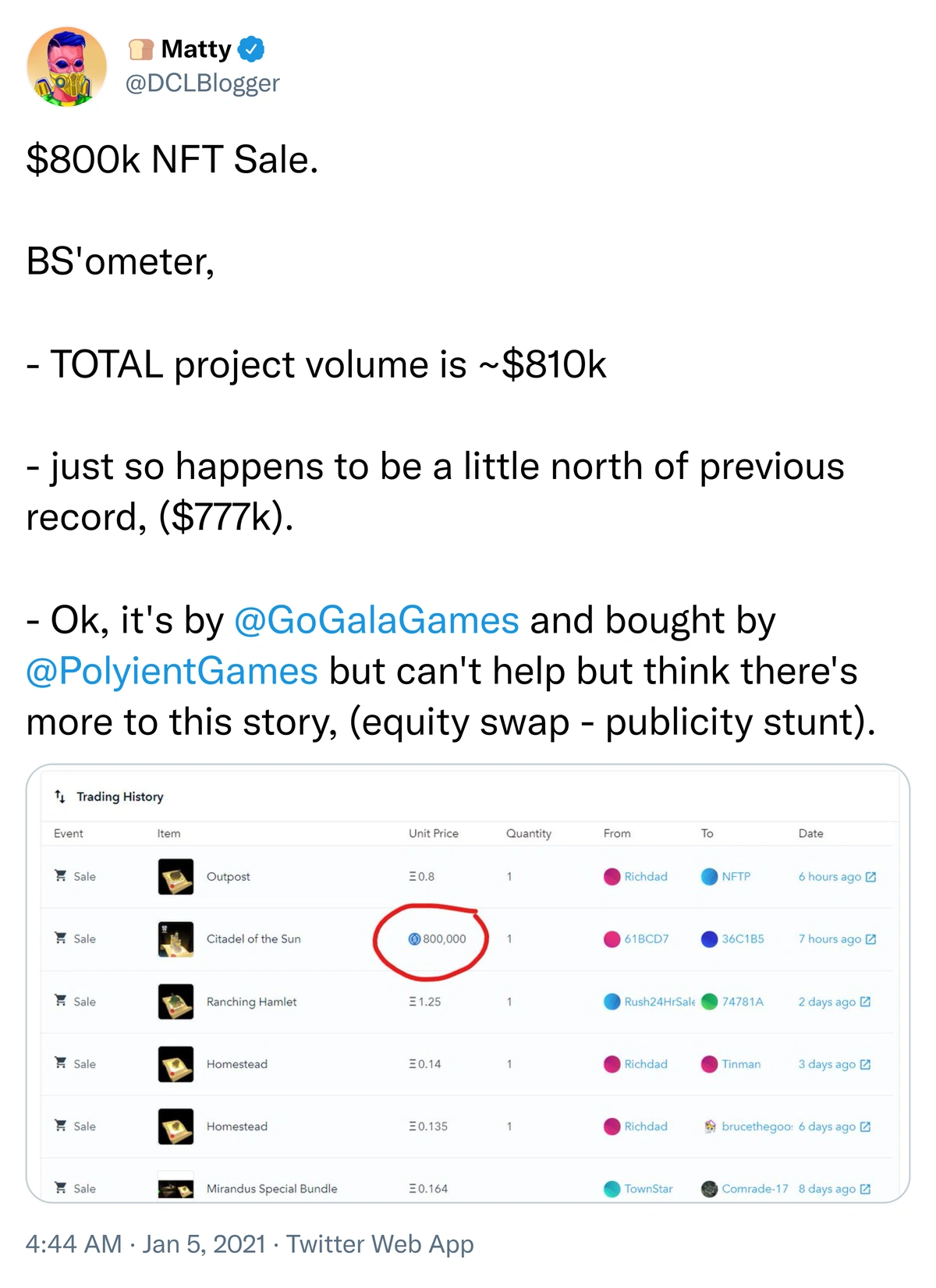

Another example of NFT bidding scam is "shill bidding," which investors or creators of an NFT or NFT collection may use to manipulate market sales. The most notorious example of NFT shill bidding is $800k worth of Citadel of the Sun NFT sale on OpenSea.

Examples:

Citadel of the Sun NFT – a case of shill bidding. (Source: OpenSea)

Last year, renowned everydays NFT artist beeple's "The Complete MF Collection" auction set the previous single-sale NFT sales record with $777,000. Gala Games, a blockchain gaming project, reportedly changed that when it sold Citadel of the Sun, a historical asset in Gala's planned MMORPG World of Mirandus, to NFT-focused investment firm Polyient Games on OpenSea for 800k USDC.

Since Polyient Games has already invested in Gala Games, the company fully endorses and supports the NFT collection. Nonetheless, several NFT experts found the enormous $800,000 price tag on a relatively undiscovered project outrageous, concluding that the transaction looked more like press attention shill bidding than honest bidding.

Pranksy – the famous NFT influencer called Citadel of the Sun NFT Sale, a case of Shill Bidding. (Source: Twitter)

Shill bidding is a form of bid rigging that helps bring attention to projects that don't legitimately attract interest and are eager to take advantage of their stakeholders. Shill bidding, when it occurs, casts doubt on the NFT ecosystem's valuations due to its artificial pricing. It's unfair to collectors and users since it forces honest bidders to pay more than they might otherwise.

Matty – another NFT influencer, also called out Citadel of the Sun NFT Sale as a case of Shill Bidding. (Source: Twitter)

Shill bidding is not specific to the NFT ecosystem; it occurs and is fought against in more traditional marketplaces like eBay as well. Most bidding or other common scams were common on traditional marketplaces before scammers adopted such tactics to target NFT collectors.

How Bored Ape NFT Owner Lost $150k on a “Joke” Bid?

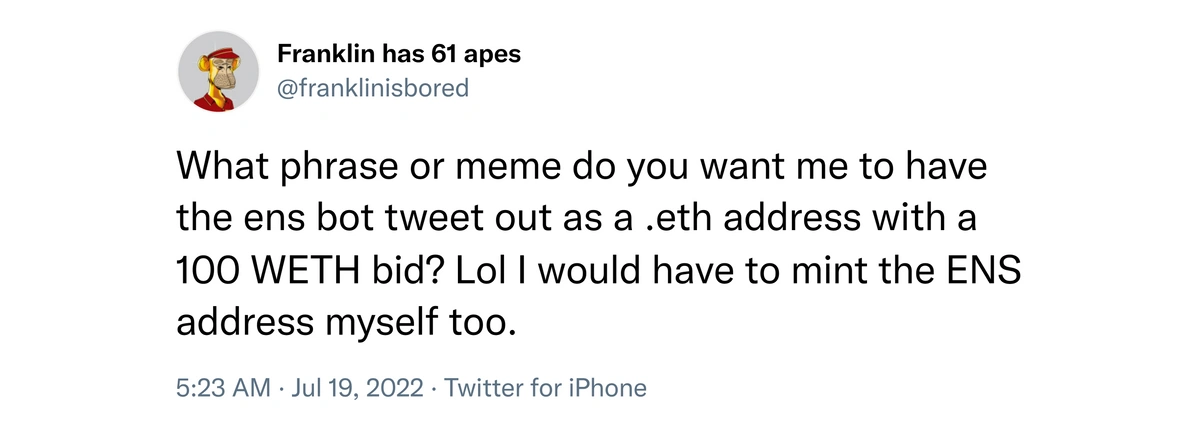

Franklin, who owns 61 bored ape NFTs and recognizes himself as the 6th largest Bored Ape Yacht Club NFT holder, recently lost around $150K by “jokingly bidding” on Ethereum Name System (ENS) domain NFT.

Franklin – a bored ape NFT holder and famous NFT influencer, lost $150k on an alleged "joke bid." (Source: Twitter)

NFT Investor Franklin Caldwell, who tweets under the handle @franklinisbored, claims he frivolously bid 100 ETH on an Ethereum Name System (ENS) domain, which is essentially a human-readable address for a cryptocurrency wallet and is an NFT.

He believed he had won the argument when he received an offer of 1.9 ETH, or around $2,900, for what was essentially a joke. Caldwell accepted the offer before remembering that he could have withdrawn it, allowing the other individual to walk away with 100 ETH.

The Takeaway – How to avoid NFT Bidding Scams?

Bidding scams are shared across different NFT marketplaces and can instantly lead investors or collectors to lose vast sums of money. For instance, the case of Franklin is a common NFT bidding scam that can affect any NFT investor, including the experts, since Franklin himself is an NFT expert but still lost $150K for a "joke bid."

You must double-check all bids on your NFT listing and verify their USD price before confirming the transaction. Similarly, you should avoid NFT projects that use shill bidding practices and remain vigilant by checking the NFT item activity on the NFT marketplace before buying it.

At NotCommon we created a way our users can help safeguard the NFT community by reporting any giveaway scams related to collections out there via our Collection Reports Form.